How GST Changes on Cement & Stones Will Reduce Housing Costs in India? : In a landmark decision aimed at boosting India’s real estate and infrastructure sectors, the GST Council announced significant changes in tax rates on key construction materials. The announcement, made during the 56th GST Council meeting, has been widely welcomed by developers, contractors, and homebuyers alike. Lets understand GST Reform 2025 in this article.

The most impactful change is the reduction of GST on cement, a cornerstone of construction projects, from 28% to 18%. Along with cement, marble, granite, travertine blocks, and other stones used in construction have also seen reductions. These changes, effective from 22 September 2025, are expected to reduce project costs, support housing affordability, and energise the construction ecosystem.

What exactly changed

The GST Council simplified the tax system by rationalising slabs and moving materials into the 5% and 18% categories. Major highlights include:

- Cement: 28% → 18%

- Marble, granite, travertine blocks: 12% → 5%

- Sand-lime bricks, stone inlay work: 12% → 5%

- General building stones: 12% → 5%

- Tiles (depending on type): 18% → 5%–18%

- Iron & steel products: unchanged at 18%

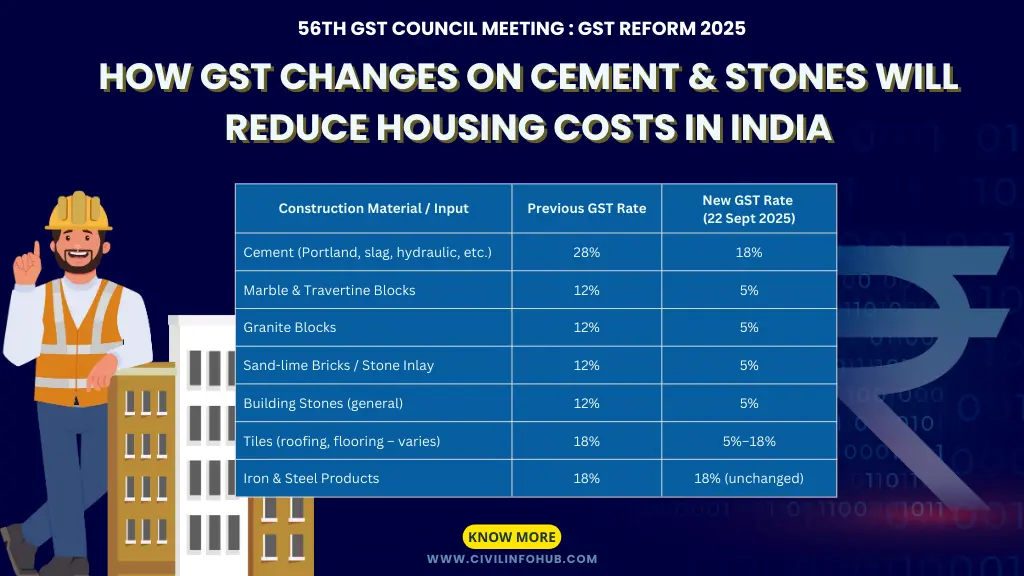

Table of GST Changes on Construction Materials

| Construction Material / Input | Previous GST Rate | New GST Rate (22 Sept 2025) | Reference Source |

|---|---|---|---|

| GST on Cement (Portland, slag, hydraulic, etc.) | 28% | 18% | Economic Times, Business Standard |

| GST on Marble & Travertine Blocks | 12% | 5% | Economic Times |

| Granite Blocks | 12% | 5% | Business Standard |

| Sand-lime Bricks / Stone Inlay | 12% | 5% | Economic Times |

| Building Stones (general) | 12% | 5% | 99acres |

| Tiles (roofing, flooring – varies) | 18% | 5%–18% | 99acres |

| Iron & Steel Products | 18% | 18% (unchanged) | 99acres |

Why this matters

Construction materials usually account for 50–60% of total project costs. By reducing GST on cement and building stones, developers save substantially on inputs. Analysts estimate that cement’s GST cut alone could lower project costs by around 3–3.5%.

Such reductions have the potential to improve builder margins and reduce the final price of housing, especially in cost-sensitive projects due to GST Reform 2025.

Benefits for Different Stakeholders

Builders & Developers

Lower material costs directly improve profitability. Developers can either pass benefits to buyers or enjoy stronger margins. Competitive pricing also makes it easier to launch new projects and attract demand.

Civil Engineers & Contractors

Lower taxes mean simpler budgeting and better cash flow. Cost savings can be used to procure better-quality materials, improve safety standards, or accelerate project completion timelines.

Homebuyers & the Common Man

With cement and stones now cheaper, buyers could see more affordable housing in the mid-segment and affordable categories. While immediate price drops are unlikely, the reforms will slow price hikes and eventually support greater affordability.

Real Estate Market

Mid-sized housing projects are expected to benefit most from these cuts. Over the long term, streamlined GST rates will encourage supply, improve liquidity, and bring greater stability to the housing market.

Implementation Notes

The new GST rates apply from 22 September 2025. Materials purchased before this date will still attract old rates, so developers need to audit invoices and procurement schedules. Contractors should also review contract terms and input tax credit (ITC) policies for smooth transition.

FAQ – GST Changes & Construction Materials

Q1. When do the new GST rates apply?

From 22 September 2025. Purchases before this date remain under old slabs.

Q2. Will housing prices immediately fall?

No. Prices may adjust gradually depending on procurement timelines and developer decisions.

Q3. Which material saw the biggest GST cut?

Cement, reduced from 28% to 18%.

Q4. Are steel and iron products affected?

No, they remain taxed at 18%.

Q5. Does this affect under-construction property buyers?

Yes, indirectly. Future purchases at lower tax rates can reduce overall costs.

Q6. What should contractors do now?

Update project estimates, re-run BOQs, and consult tax advisors for ITC compliance.

Q7. Is this the final GST structure?

For now, yes. The Council may revisit slab structures in the future.

Conclusion

The GST cuts on cement and stones mark a turning point for India’s construction industry. Builders save costs, contractors can optimise budgets, and homebuyers may enjoy more affordable homes in the long run. While immediate price drops may be limited, the long-term benefits of reduced construction costs will ripple across the housing and real estate market, supporting sustainable growth.

Disclaimer

This blog post is created for informational purposes only. While we strive to provide accurate and updated information, readers are advised to cross-verify with official GST Council notifications and seek professional advice for project-specific tax or legal implications.

CivilInfoHub is not liable for any business, financial, or legal decisions made solely on the basis of this article.

Read More :

https://civilinfohub.com/crs-reinforcement-steel-used-in-construction/

https://civilinfohub.com/fly-ash-ggbs-in-ready-mix-concrete/

1 thought on “How GST Changes on Cement & Stones Will Reduce Housing Costs in India : GST Reform 2025”